FINANCIAL FREEDOM

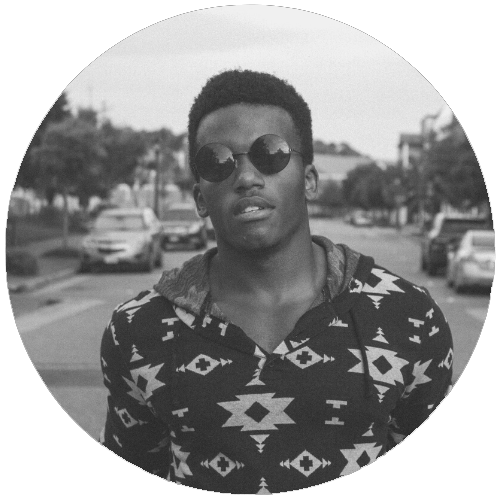

Paul Harrison, who is principal analyst at Fortune Investment Group, takes us through the charm of the investment market and the strategies of stock trading, so that all fans who follow him can turn losses into profits in the stock market.

Success as a trader has

everything

to

do with your ability to:

- Find stocks which have the highest probability of profiting

- Understand how to read the Market Data

- Change your mindset and your trading to the NEW way the market moves!

Our Goal Is To Help You

Master

The Art Of Being An

Expert Trader

We Are On A Mission To Help Others To Achieve The Results That They Always Wanted...

What can I learn at Paul Harrison?

Learning includes various stock selection ideas, trading strategies and

investment concepts. Have the confidence and knowledge to trade every

day.

How to avoid stock market risks and expand investment returns.

Our goal: to build Fortune Investment Group into a first-class financial

institution so that all investors who lose money can find a safe

haven.

Whether you are a casual or professional trader, you can trust us at

Fortune Investment Group.

Limited time free, Join our Group to learn more about stock market

investment strategies.

Learning includes various stock selection ideas, trading strategies and investment concepts. Have the confidence and knowledge to trade every day.

How to avoid stock market risks and expand investment returns.

Our goal: to build Fortune Investment Group into a first-class financial institution so that all investors who lose money can find a safe haven.

Whether you are a casual or professional trader, you can trust us at Fortune Investment Group.

Limited time free, Join our Group to learn more about stock market investment strategies.

Why Paul Harrison?

- I am 45 years old and currently reside in the Hamden neighborhood of New York City, U.S.A. I have nearly 15 years of investment experience with a leading U.S. investment bank. I have been researching and analyzing stocks of various companies, tracking market dynamics and developing comprehensive investment strategies since I graduated from college. Throughout my career, I have experienced market volatility and challenges and have learned the importance of risk management and emotional control. I specialize in finding undervalued stocks and finding investment opportunities through in-depth research and analysis. I strongly believe in the importance of long-term investment planning, focusing on prudent assessment of fundamentals and industry outlook. In addition to achieving success in the stock market, I am also adept at maintaining close ties with other investors and experts to constantly expand my investment horizons.

- Paul Harrison embarked on his responsible investing journey as an investor for the renowned George Soros's foundation. This foundation laid the path for his roles at global frontrunners like FRM, Protégé, and APG, known globally for their dedication to Environmental, Social, and Governance investing. Furthermore, Paul Harrison has been an ESG investing educator at prestigious business schools, helping the next generation grasp its significance. He holds the acclaim of co-authoring an impactful academic paper that delves deep into the application of machine learning to allocate optimally to the United Nations Sustainable Development Goals. This significant work was recognized and published by The Journal of Impact and ESG Investing. Outside of his direct professional roles, Paul Harrison was a pivotal co-founder of Project Punch Card, a non-profit organization dedicated to enhancing diversity in the investment sector. This initiative aims to pave the way for careers in investment for groups that have been traditionally under-represented.

- His influence spreads across multiple advisory boards. Paul Harrison is an esteemed member of AIMA's Global Investor Board, Milken Institute's Global Capital Markets Advisory Council, and provides valuable insights to the Paul Harrison Price Student Investment Fund's management advisory council. Furthermore, he plays a pivotal role as a Special Advisor to The Tokyo University of Science's Endowment. Paul Harrison's innovative approach to finance is evident in his co-founding of the podcast "Improving Alpha: Innovation in Investing, ESG, and Technology". His fascination with technology also led him to co-found The Artificial Intelligence in Finance Institute. An active member of The Economic Club of New York, Paul Harrison's leadership has been recognized during his tenure as Chair at CFANY, earning him multiple accolades, including the 'Volunteer of the Year' award. With his vast knowledge and experience, Paul Harrison has contributed to The World Economic Forum's research on the implications of AI in Finance. His expertise is sought after, and he often takes the stand as an expert witness, testifying on critical financial matters.

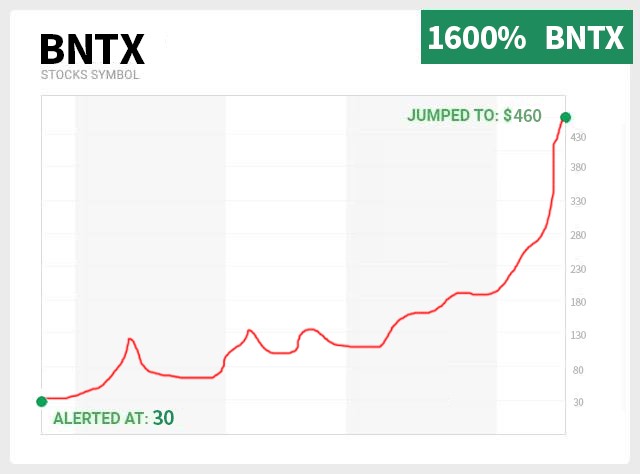

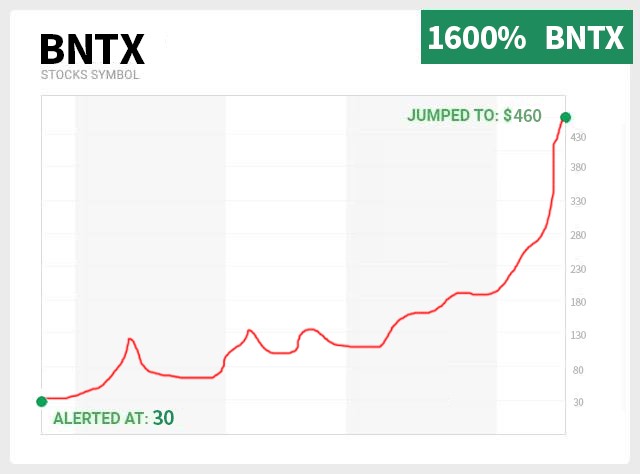

- 1.NET from March 2021 to October 2021, from the price of 70-179, it made a profit of 150% after 7 months. Profit $360 million 2. BYD HK made a profit of 700% in 8 months from March 2021 to November 2021, from a price of 38-308. Profit $430 million 3. From April 2023 to July 2023, SMC1 made a profit of 170% from the price of 110-305 in 3 months. Profits of US$220 million

10 secrets to help you

take the guesswork out of

trading

- Secret #1: Triple Stock Profit System - An easy way to triple your profits by simply owning stocks.

- Secret #2: Covered Call - An Advanced Way to Guaranteed Potential Earnings!

- Secret #3: Bullish Strategy - Take advantage of rising stock prices for potential profits.

- Secret #4: Profit From Sideways Movements - Explore ways to potentially profit from stable stock prices.

- Secret #5: Bearish Strategy - Learn a method to potentially profit from falling stock prices.

- Secret #6: Avoid Pattern Day Trading Problems - 3 Effective Ways to Circumvent Pattern Day Trading Rules and Prevent Account Lockouts.

- Secret #7: 3 Easy Ways to Blow Up Your Account - Learn why you should avoid these ways to blow up your account.

- Secret #8: Trading the Yield Curve - Seize the opportunities presented by changes in the fed funds rate.

- Secret #9: Trade Like a Casino - Employ casino-inspired strategies in your portfolio for success.

- Secret #10: Trading in 60 Seconds - Master the art of high probability stock trading in under a minute.

Understanding

Markets

- Understanding Markets &Exchanges

- Test: Markets and Exchanges

Money Management

- Money Management

- Test: Money Management

Five Rules of Trading

Psychology

- Rule One: Do Your Own Research

- Rule Two: Stay In Your Weight Class

- Rule Three: Pay Attention

- Rule Four: Check Your Ego

- Rule Five: Move On

Introduction To

Technical Analysis

- Charts &Candlesticks

- Moving Averages

- Relative Strength Index

- Technical Analysis Review

- Test: Technical Indicators

Six Kinds Of Trades

- Trend Trade: Example One

- Trend Trade: Example Two

- Regular Moving Average Trade: Example One

- Regular Moving Average Trade: Example Two

- Base Trade: Example One

- Base Trade: Example Two

- Consolidation Trade: Example One

- Double Top/Double Bottom Trade: Example One

- Double Top/Double Bottom Trade: Example Two

- Far From Moving Average Trade: Example One

- Far From Moving Average Trade: Example Two

- Test: Six Kinds of Trades

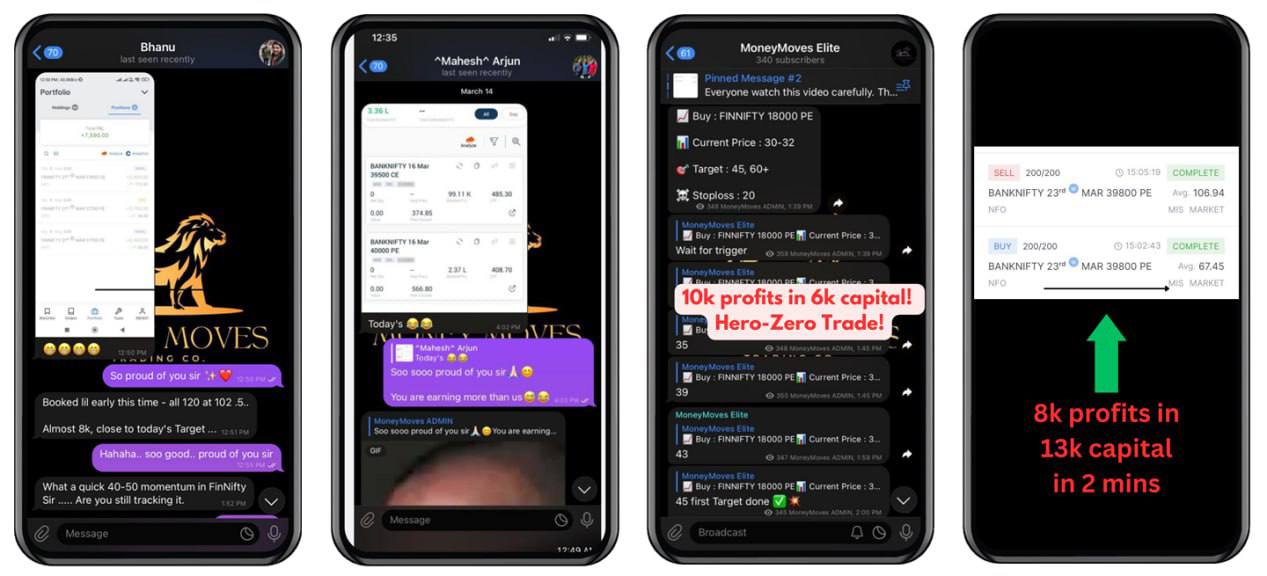

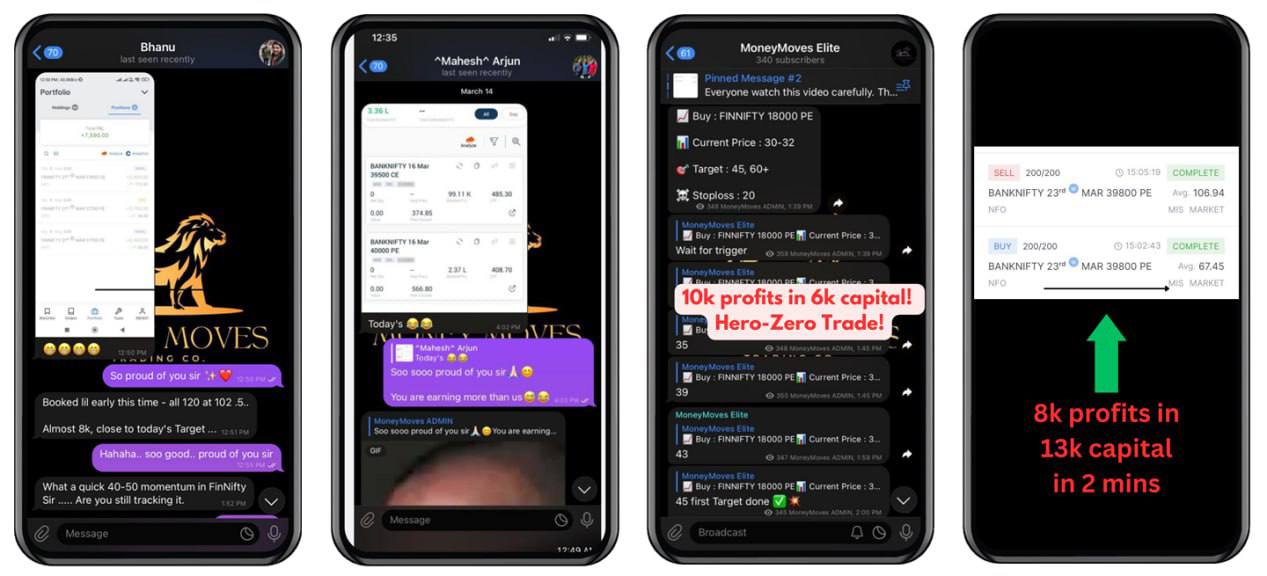

Can You See

Why So Many

People Just

Like You Are

Raving About Trading

With Us?

Robert Z.

Richard M.

Mauricio C.

Leo S.

CW H.

Federico A.

Our Promise

Providing our students with a step-by-step program and successfully using our superior skills, tools and guidance and proven practical principles to teach our students how to become winners in the stock market.